How I use Mint, Personal Capital, and Wealthfront to Manage my Finances

I’m a big believer in Marc Andreessen’s view that software is eating the world and more and more of our daily lives will be improved by technology running brilliant software. One sector in which we are already seeing this shift is personal finance.

In just the last few years I’ve moved much of my financial management to next generation software solutions that greatly simplify my life. I wanted to share how Mint, Personal Capital, and Wealthfront have each become important parts of my financial management strategy.

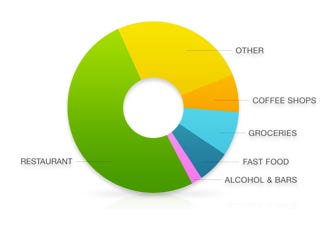

My primary use of Mint is to easily analyze my monthly discretionary spending. By integrating my primary spending accounts (credit cards, checking accounts, and savings accounts) I can see a total of my monthly spending as well the breakdown by expense category. No longer do I have to tediously categorize transactions in my own spreadsheet or more realistically, rely on my faulty memory for knowing how I’m spending my money.

Mint does a decent job of categorizing my transactions across high level categories like food & dining, bills & utilities, shopping, entertainment, and more. Though it does miscategorized transactions every so often, the directional values are helpful to know where my money is going.

If you’re particular about correctly classifying each and every transaction, you may find Mint’s occasional inaccuracies frustrating and are likely better off sticking with your own spreadsheet. However, if you’d like a nice weekly summary of your spending with almost no work, Mint is the perfect tool for you.

I also use Mint’s Ways to Save feature to help me optimize my other financial accounts. For example, I recently switched to the Chase Sapphire Preferred credit card as suggested by Mint since it maximizes cash rewards, especially for someone like me with high dining & travel expenditures. Similarly, I opened a American Express Personal Savings account, as recommended by Mint, for their high yield savings account.

I also used to use Mint for tracking my overall net worth, but after the Intuit acquisition I experienced significant issues with their third-party integrations to many of the investment and saving financial institutions I use.

So I switched to Personal Capital, an alternative financial aggregation tool that provides the same comprehensive aggregation of all your financial accounts. It has had great support for almost all of my credit card, checking, saving, 401k, IRA, investment, brokerage, and online banking accounts that I have. One of the challenges in working in technology startups is you switch roles frequently, resulting in a myriad of legacy 401k and IRA accounts scattered across institutions. Personal Capital certainly helps to give you a comprehensive view of your entire financial portfolio.

I use it to keep tabs on whether I am achieving my desired savings rate and to ensure I’m maintaining my desired allocation of funds across asset classes.

When it comes to managing my savings, I’m a big believer that you should ideally keep 6-12 months worth of living expenses in cash or other liquid assets, then allocate up to 20% of the remaining capital to discrete investment opportunities that you believe in, and invest the remaining 80% in a well diversified portfolio across various asset classes.

It’s this last category of investment that Wealthfront excels at. Ever since my investment management class at Wharton, I’ve believed that it’s very difficult to beat the market, either yourself or through active fund managers. While certain funds do occasionally outperform, it’s difficult to ensure consistent performance over time. Given this, I’ve always invested in index funds that cheaply give me exposure to a certain asset class. And then I’ve diversified this exposure through investment in various asset classes. Wealthfront fundamentally agrees with this philosophy and manages an investment portfolio accordingly to these principles automatically for you.

You start by determining your risk tolerance through a simple survey of a few questions. This informs your allocation across the six asset classes they support (us stocks, foreign stocks, emerging markets, real estate, natural resources, and bonds). A lower risk tolerance will result in larger exposure to less volatile asset classes, like bonds. Wealthfront then uses ETFs to gain exposure to each of these asset classes, which is an even cheaper alternative when compared to index funds as far as expense fees. Wealthfront also automatically reinvests dividends and automatically rebalances your portfolio to the appropriate allocation as your exposure to each asset class changes over time.

Wealthfront takes all the work out of managing a well diversified portfolio. Simply set your risk tolerance, make your initial investment, and keep depositing new savings as you accrue it, and Wealthfront does all the rest!

There is still so much opportunity for brilliant software in personal finance. Can’t wait to see how this industry evolves over time.

Whenever you’re ready, here are 3 ways I can help:

AI Productivity: Learn how leading product managers use AI to become faster, smarter, and gain super powers beyond their traditional role.

Mastering Product Management: Accelerate your product career by learning rigorous frameworks for each PM deliverable, from crafting a strategy to prioritizing a roadmap.

Product Innovation Strategy: Building a new product? Learn how to leverage the Deliberate Startup methodology, a modern approach to finding product/market fit.